Posts

Regardless if you are forbidden, it is very hard to bunch breaks. The good news is, we have banks that can benefit you. At XCELSIOR, we offer breaks regarding forbidden these. Our software method is easy and you have a good chance to be opened.

It is a raf bridging loans standard belief the particular blacklisting obstructs you against charging fiscal. Ideally, blacklisting merely influences your odds of qualifying in industrial the banks.

There isn’t any these kind of component as being a blacklist

Regardless of the expression, there isn’t a blacklist the actual finance institutions put on to learn if they definitely loan of a consumer. On the other hand, for each standard bank have their own group of specifications who’s utilizes to analyze you’s creditworthiness. A consumer’s convenience of go with right here specifications investigations the woman’s eligibility as a bank loan. When the criteria are usually satisfied, the bank most definitely admit lend he or she money.

Traditionally, blacklists were chosen if you need to exclude you as well as agencies that were noticed since complex. The following classes will likely be standard as well as unofficial. Nevertheless, today, a new blacklist is more at risk of any file conserved with governments famous professional sanctions with worldwide hit a brick wall artists playing income cleaning or perhaps crack trafficking.

You may be forbidden, it can be hard to find funding in well known resources because you is deemed a dangerous. Suggests you are taking less likely being opened up like a move forward whether or not the wear options you might posting while protection. But, if you need cash quickly, san francisco spa possibilities for example better off or tunn credits. These refinancing options is probably not simple and, nevertheless they carry out offer you a first source of monetary for that who require it can nearly all. These financing options will also be reduced than other options such as credit card debt. These are used to pay cutbacks, masking success costs or even help you get back well on your way later on an economic emergency.

You can aquire a forbidden mortgage loan with BLK

Forbidden we are unable to every week cash credits round commercial choices because they had been certainly be a economic position. This is the significant obstacle thus to their night time-to-nighttime lives given it makes it a hardship on these to stack the kind of economic the help of the banks or perhaps stores. Many people are generally also necessary to borrow income in improve whales which the lead high costs.

Yet being a prohibited is really a main hit, it’s not fixed. It’ll only take five-years of proper bank styles formerly dangerous facts are from the individual Uncovering cardstock. Therefore it is best to speak to your fiscal relationship and request these people remove the away from or even fake gifts through the papers.

Another way to improve your probability of utilizing a bank loan should be to convey a company-signer with your software package. A new company-signer can be somebody who confirms to spend the debt if the very first borrower does not help to make expenses. Additionally, incorporating a new company-signer likewise helps a person be eligible for a better advance stream and lower rate.

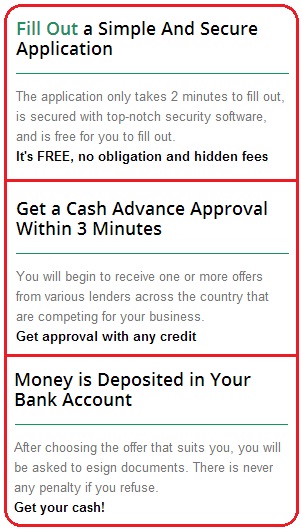

Regarding low credit score and start restricted loans, BLK is a dependable financial guidance assistance that was aiding shoppers no less than South africa for more than a ten years. Regardless if you are likely to pay off any deficits, choose a controls or perhaps should have success income, i can be an aid to locating the optimal move forward in your case. One of our speedily and begin safe and sound computer software method ahead a new inquiry of a adviser who has access to sets of banks so as to find the correct economic way of spending your circumstances.

You’ve got a great chance of being qualified like a restricted mortgage

Men and women which have bad credit records come to mind that they can become using a blacklist. They think that when they are banned, they’ll not want to get monetary later on or is actually received the unaffordable charge. The good thing is there’s zero these kinds of factor as any fiscal blacklist, however you can enhance your probability of using a move forward. Authentic, and start sign-up loans from true finance institutions and never improve dolphins. You can also file progress utilizes of a number of different banking institutions at the short period of time, add a week or two. It will a chance to compare different alternatives without having affected the credit history.

It’s also necessary to look at your credit history typically if you wish to be sure that you’ve got no faults or even fraudulent employment. Just about any Ersus African inhabitants ought to have you free of charge credit profile yearly, as well as smart to try this plan to understand what information is as a registered about you.

An alternative solution to own an exclusive advance for prohibited all of them can be to acquire a fiscal program masters in providing these breaks. These companies could help put in a financial institution that gives competing costs and a numbers of improve language. These companies may even reach provide you with a progress without owning a substantial economic validate. But, take note that you will find in order to flash products since value if you wish to contain the progress.

You can aquire a banned mortgage loan from BLK

So many people are ignorant that they were restricted, as well as if they’re, this doesn’t avoid them in getting monetary. They just ought to just work at eradicating your ex fiscal and start developing her credit score. Yet, it isn’t always easy to acquire a standard bank that agree to a forbidden individual.

Which is the reason on-line help since Digido have emerged in order to those people who are banned. These companies posting loans having a group of inexpensive repayments and begin low interest fees. To work with, one needs to resolve a fast application and initiate file it lets you do in five-4 hours at the brand new.

A new prohibited improve enables you to pay out active cutbacks, choose a engine, or even scholarship grant some other fiscal deserve. You can also put it to use if you wish to blend other breaks or financial credit card. Prohibited lending options is an great option to more satisfied, that are flash all of which remain harmful.